Many of us have followed the dramatic rises and precipitous falls of bitcoin, and cryptocurrencies in general, over the past few years. Some may have written them off entirely after 80% declines in 2018, only to see them roar back into investors’ collective consciousness in 2020.

Certainly sentiment has shifted over a short two years—more institutional investors are taking a hard look at crypto and previous naysayers have softened their view. This all leads to one question: How much cryptocurrency should I own?

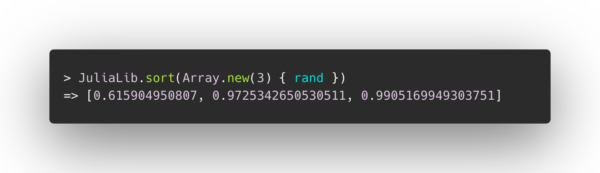

Math to the rescue.

It goes without saying that this is a hard question to answer. But, we can borrow a page from modern quantitative finance to help us arrive at a potential answer.

For years, Wall Street “quants” have used a mathematical framework to manage their portfolios called the Black-Litterman model. Yes, the “Black” here is the same one from the famous Black-Scholes options pricing formula, Fischer Black. And “Litterman” is Robert Litterman, a long-time Goldman Sachs quant.

Without getting into too much detail, the model starts with a neutral, “equilibrium” portfolio and provides a mathematical formula for increasing your holdings based on your view of the world. What’s amazing is that it incorporates not just your estimate about how an investment might grow, but also your confidence in that estimate, and translates those inputs into a specific portfolio allocation.

Your starting point: 0.50%

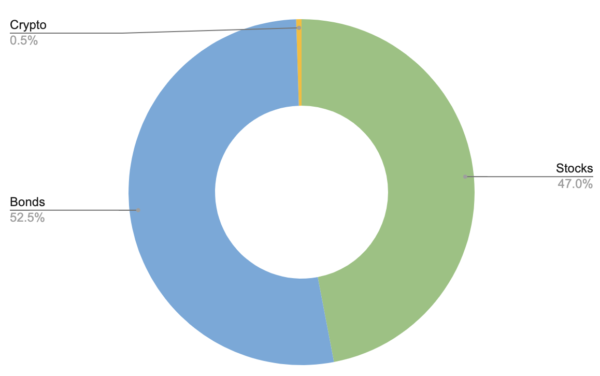

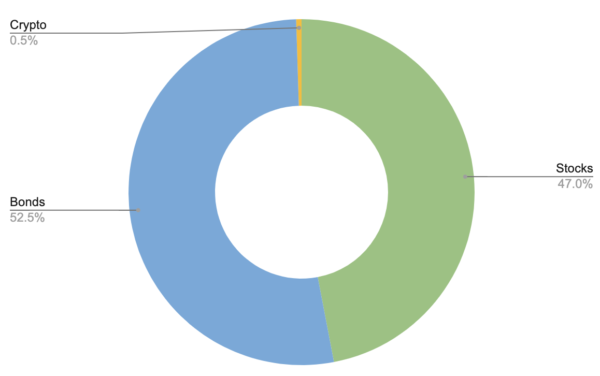

The Black-Litterman model uses the global market portfolio—all the asset holdings in the world—as its starting point for building a portfolio. This means that, if you don’t have any other views on what investments might perform better or worse, this is the portfolio you should consider holding.

In early 2021, the global market for stocks totaled $95 trillion and the global bonds market reached $105 trillion. The cryptocurrency market as a whole was valued at roughly $1 trillion. This means that cryptocurrency represents 0.50% of the global market portfolio.

The Global Market Portfolio In Early 2021

Source: Betterment sourced the above cryptocurrency data and stock and bond data from third parties to produce this visualization.

Just as there are plenty of arguments to hold more cryptocurrency, there are also many arguments to hold less. However, from the model’s standpoint, 0.50% should be your starting allocation.

Now, add your views.

This is where the mathematical magic comes into play. For any given growth rate in cryptocurrency (or any investment for that matter), the Black-Litterman model will return the amount you should hold in your portfolio. What’s more, you can specify your level of conviction in that assumed growth rate and the model will adjust accordingly.

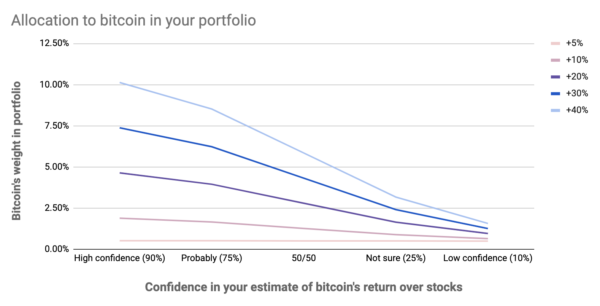

In the below chart are the portfolio allocations to bitcoin derived from the Black-Litterman model. This chart can serve as a useful, hypothetical guideline when thinking about how much cryptocurrency you might want to hold.

How to use it: Select how much you think bitcoin will overperform stocks, from +5% to +40%. Each return expectation corresponds to a line on the chart. For example, if you think that bitcoin will outperform stocks by 20%, this corresponds to the purple line. Now, follow the line left or right based on how confident you are. If you’re at least 75% confident (a solid “probably”), the purple line lines up with a 4% allocation to bitcoin.

Graph represents a hypothetical rendering of confidence of return value based on inputs to the Black-Litterman model. Image does not represent actual performance, either past or present.

One of the most interesting things to note is how high your return estimate needs to be and how confident you need to be in order to take a sizable position in bitcoin. For example, for the model to tell you to hold a 10% allocation you need to be highly confident that bitcoin will outperform stocks by 40% each year.

Also of note, it does not take much to drive the model’s allocation to 0% allocation, ie: no crypto holdings. If you don’t think that there’s a 50/50 chance that bitcoin will at least slightly outperform, the model says to avoid it entirely.

How we got here.

The inputs to the Black-Litterman model tell an interesting story in and of themselves. The main inputs into the model are global market caps, which we discussed earlier, asset volatility, and the correlation between assets.

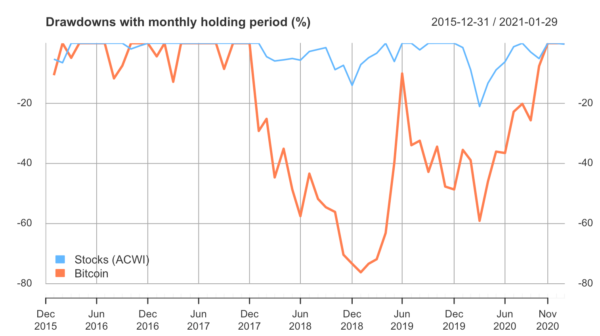

It goes without saying that cryptocurrencies are risky. Over the last five years, bitcoin’s volatility was six times that of stocks and 30 times that of bonds. At its worst, the digital coin saw an 80% drop in value, while stocks were down 20%. Other cryptocurrencies fared even worse.

Source: Betterment sourced the above ACWI data and Cryptocurrency data from third party sources to create the above visualization. Visualization is meant for informational purposes only and is not reflective of any Betterment portfolio performance. Past performance is not indicative of future results.

If an asset is volatile, and one is not able to diversify that volatility away, then investors will require a higher rate of return on that investment, otherwise they will choose not to invest.

The fact that bitcoin is so volatile, but has such a small number of investors (relative to stocks or bonds) suggests that many investors still do not see the potential returns worth the risks. On the other hand, cryptocurrencies are at their core a new technology, and new technologies always have an adoption curve. The story here may be less about expected return versus risk and more about early adoption versus mass appeal.

The final ingredient in the model is bitcoin’s correlation with stocks and bonds. Bitcoin has some correlation with both stocks and bonds, meaning that when stocks go up (or down), bitcoin may do so as well. The lower the correlation, the greater the diversification an asset provides to your portfolio. Bonds have a low correlation with stocks, which makes them a good ballast against turbulent markets.

Bitcoin’s correlation is higher, meaning that it can provide some diversification benefit to a portfolio, but not to the same degree as bonds.

Cryptocurrencies can be a component of your financial plan—but it shouldn’t be the only thing.

While it can’t tell you if bitcoin will be the next digital gold, this mathematical model can help you think about what kind of allocation to crypto might be appropriate for you and what assumptions about risk and return might be underlying it.

Even though Betterment currently doesn’t include cryptocurrency in our recommended investment portfolios, you can learn more about how to invest appropriately in it using our cryptocurrency guide.

Since crypto should only comprise a small percentage of your overall portfolio, you should still have a diversified portfolio and long-term investment plan that will help you meet your financial goals. Betterment can help you plan for the short and long term, recommending the appropriate investment accounts that align with your financial goals and allowing you to select your preferred risk-levels. You can also align your investments with your values by using one of our three socially responsible investing portfolios.

Invest with Betterment

Join us>